Around 90% of disasters recorded worldwide in 20 years were caused by natural phenomena such as floods, storms, cyclones, landslide, heat waves and droughts, fires, tsunami based on the report published by U.N in 2015. Parametric insurance covers the financial consequences of weather conditions.

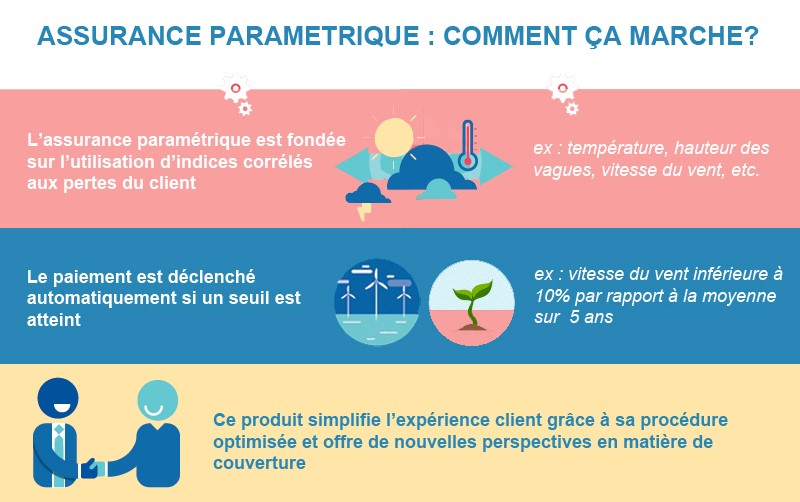

In parametric insurance, compensation for a loss is triggered when an index, usually a weather index, exceeds a certain pre-set threshold.

In the event of a disaster, all insured individuals throughout the covered area will be automatically compensated based on a simplified claim and settlement process.

The amount of the indemnity to be paid to each Insured is pre-set based on the index level provided for in the policy.

With this principle, the costly intervention of an expert to assess the damage is not necessary, prices are reduced and the compensation process is then expedited: around 5 working days.

Unlike traditional insurance covering damage to property, e.g. flood damage caused to rice production, parametric insurance covers a yield, a figure, e.g. shortfall caused by the destruction of rice. It helps maintain the income of the Insured in the event of adverse weather conditions. Because of the limitations of traditional farming insurance, parametric insurance is product that serves farmers’ needs.

This booming market is growing by gaining a substantial advanced expertise developed through a strenuous collaboration with agriculture, renewable energy, construction, transport, leisure and textile, distribution as well international institutions and governments facing natural disasters with frightening financial and human consequences.

The first players to enter the index-based market were reinsurers, which gives them de facto, a competitive advantage. For example, Swiss Re has a historic partnership with the World Bank, which initiated the implementation of the index-based insurance in its early stages, in many developing countries.

Recently, index-based insurance is no longer being sold exclusively by re-insurers with insurance companies satisfied and some of them have already started marketing the product. Including AXA Pacifica in France.